April 5, 2025 – The woodworking machinery sector is undergoing transformative shifts driven by sustainability mandates and digital innovation, with market dynamics revealing both opportunities and challenges across key regions.

1. Market Growth Amidst Sustainability Pressures

The global woodworking machinery market is projected to reach USD 7.77 billion by 2032, fueled by a 5.6% CAGR, as demand surges for automated solutions in furniture and construction sectors

This growth coincides with tightening regulations like the EU’s Circular Wood Products Regulation (effective 2027), requiring full material traceability

1Notably, 58% of manufacturers have adopted closed-loop glue systems, reducing VOC emissions by 37%

while energy-efficient drying kilns and AI-defect detection systems are gaining traction at major expos like the Vietnam International Woodworking Machinery Fair

2. Regional Dynamics Reshaping Supply Chains

- Asia-Pacific: Dominates production with China accounting for 76% of global machinery output (19M units in 2024)7. Vietnam’s wood exports (USD 3.8B in Q1 2025) drive demand for CNC contour mills, though domestic raw materials only meet 30-35% of needs1.

- North America: Timber cutting machine market to hit USD 3.52B by 2032, spurred by forestry investments and HOMAG’s SAWTEQ O-100 launch for precision panel cutting8.

- Europe: Faces workforce shortages (affecting 34% of manufacturers) despite innovations like WEINIG’s Glu-Jet system cutting adhesive use by 40%47.

3. Technology-Driven Productivity Gains

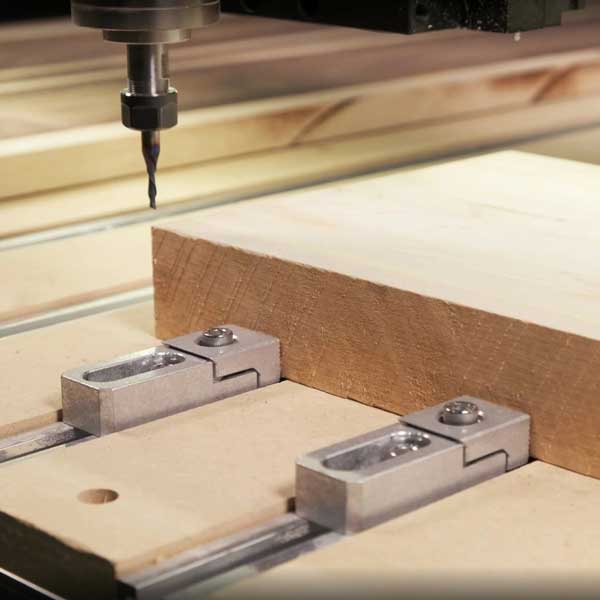

Digital twin-enabled production planning and 5-axis CNC machines (0.01mm precision) are revolutionizing workshops. Key developments include:

- IoT-optimized toolpaths boosting efficiency by 30%3

- Hydrogen-powered thermal processing systems reducing carbon footprints4

- Modular architectures bridging energy management and automation4

The Dubai WoodShow 2025 will spotlight these trends, featuring sessions on Scandinavian timber logistics and Middle Eastern market forecasts

4. Sustainability as Market Differentiator

FSC-certified timber adoption has become critical for EU market access, with Vietnam accelerating certified forest planting to avoid EUDR-related trade barriers

Engineered wood products like CLT now dominate 23% of construction applications, driven by prefabricated housing trends in the U.S. and Europe

Slovenian manufacturers exemplify this shift, leveraging wood’s carbon sequestration capabilities while addressing lifecycle environmental impacts

5. Persistent Industry Challenges

- Supply Chain Volatility: Hardwood prices surged 19% YoY, compounded by geopolitical disruptions17

- Skills Gap: Only 42% of Asian manufacturers have implemented “smart workshop” solutions due to technical workforce shortages3

- Regulatory Complexity: Over 60% of SMEs struggle with multi-jurisdictional compliance for timber sourcing1